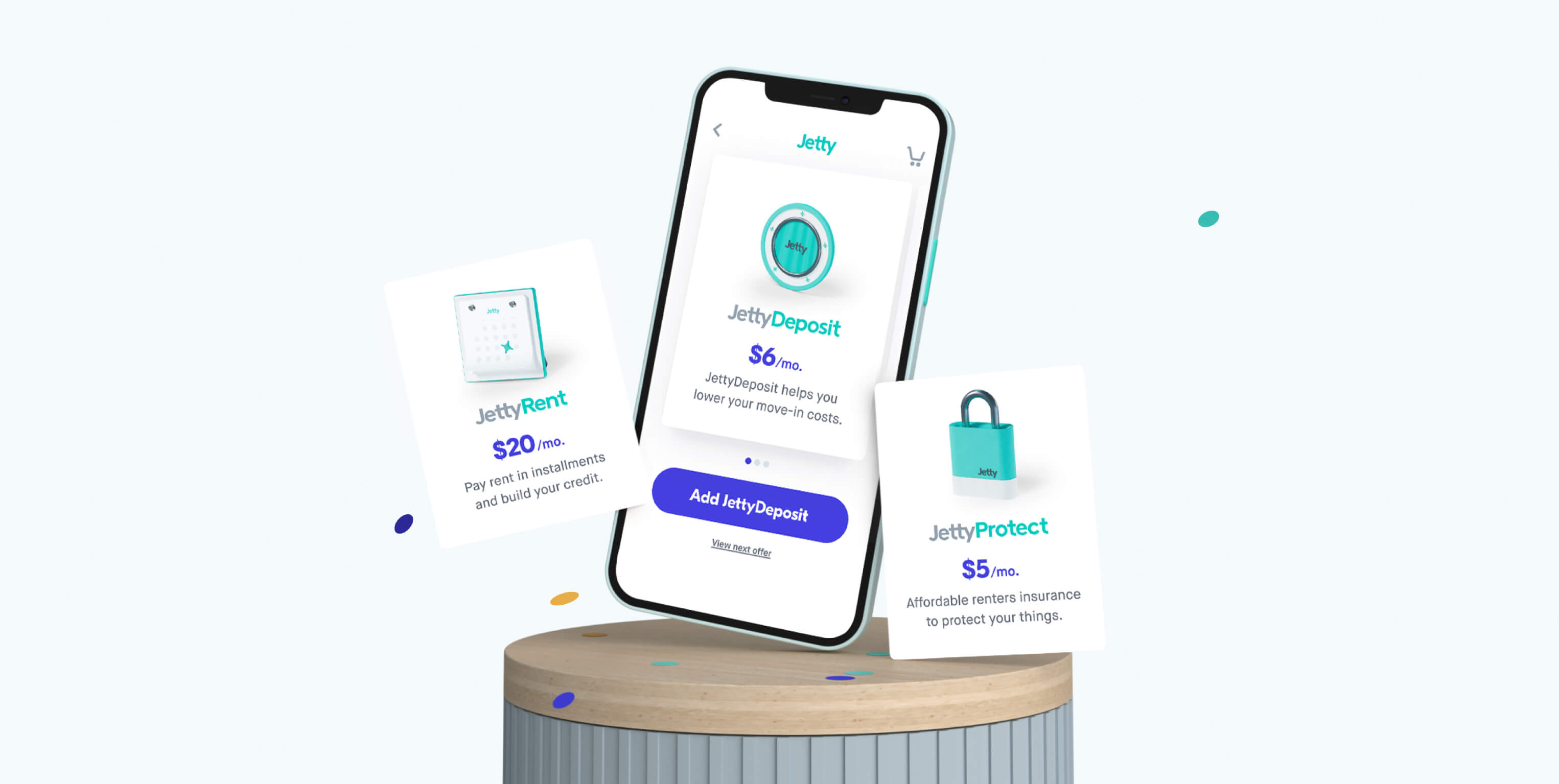

Financial servicesfor renters.

Jetty is the financial services company for real estate. Our products are designed to improve the financial lives of renters and their property managers.

Our Customers

We’re here to help both sides of the lease.

Renters

Learn MoreFor RentersLower your move-in costs, pay rent on your own terms, and protect the things you love.

Our Products

New tools for old problems.

We’ve built multiple financial products to reimagine renting—making it more affordable for renters and more profitable for property managers. And we’re just getting started.

The security deposit replacement that swaps expensive cash deposits for a low monthly or one-time payment.

A new credit building service built for renters.

Why Jetty?

Unrivaled across every dimension.

It’s not just the products themselves that make Jetty unique—it’s how they’re designed, packaged, and delivered that makes us the only choice for discerning renters and property managers.

Multiple products. One Jetty.

Jetty offers multiple financial products for renters and property managers under one roof.

Simple, fast, and secure.

Our products rely on stunning, functional design and cutting edge technology to make for the best experience around.

Best-in-class support.

We know the value of service. That’s why our in-house team is always ready to help when you need it.

Our Partners

Trusted by the biggest names in real estate.

The leading real estate companies in the country have chosen Jetty to replace their old way of doing business. We’re available in two million (and counting!) rental units across the country.

Learn more about the benefits of Jetty.