Reduce bad debt with deposit-free leasing.

Request DemoWhat It Does

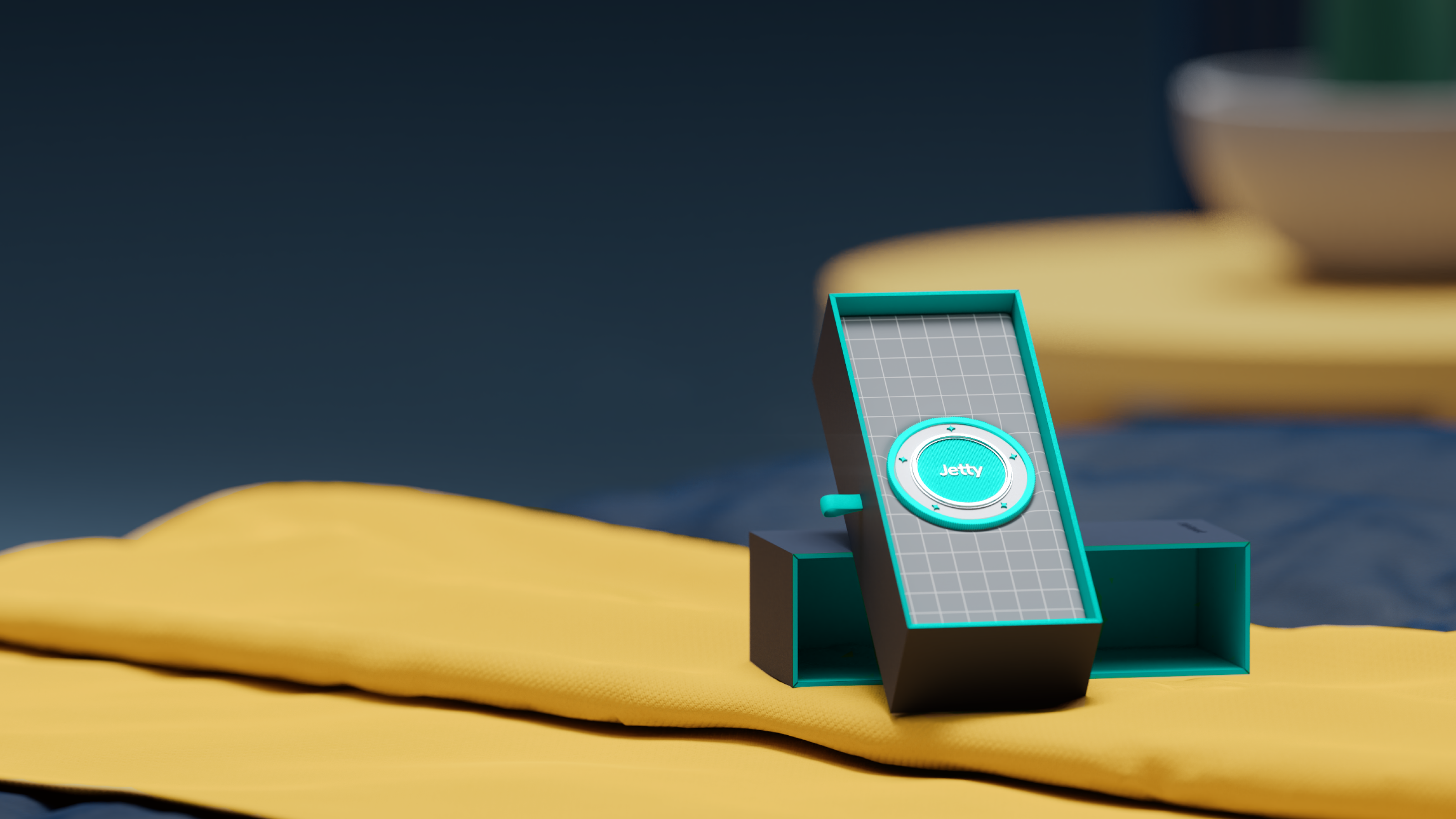

A dynamic new tool for leasing.

A replacement for traditional security deposits.

Low-cost policies that reduce the financial burden on renters and remove the need to accept and manage cash.

Policy coverage that meets your needs.

Just like traditional cash deposits, Jetty Deposit will cover you for lost rent, damage to your units, and unpaid fees.

Why jetty deposit

The most trusted and complete offering on the market.

Comprehensive protection.

Our coverage doesn’t include claims limits on categories like lost rent or damage—you’re covered for the full value of our bonds.

Flexible coverage amounts.

We give you the ability to tailor your coverage amounts at a property and resident level, giving you exactly the protection you need.

Reliable claims process.

Our claims are processed by a team of in-house adjusters so your claims get approved and paid quickly with ease.

Your compliance partner.

Our products have been approved by every states’ Department of Insurance, keeping your properties in compliance with emerging deposit legislation.

FAQ

Got questions?

Here are a few of our most frequently asked questions.

Jetty Deposit is a deposit alternative solution that replaces traditional cash deposits with low-cost surety bonds. The product dramatically lowers move-in costs for your applicants which helps you increase lease conversions.

With Jetty Deposit, you can specify the amounts of protection you require at both a property and applicant approval level. This flexibility ensures you have the protection you need and can minimize the risk of bad debt.

At move-out, you present your residents with a statement detailing any outstanding balances and, if they fail to settle their account, you can file a claim with Jetty up to the total bond amount. Jetty will then assume responsibility to recover the outstanding balance directly from the resident.

Everyone you approve is automatically approved for Jetty Deposit. When you join the program, we will create a custom sign-up website for your applicants to use. Signing up takes minutes and can be done right in the leasing office.

Prices will vary according to the amount of protection you require as well as applicants' credit scores. Applicants can pay for Jetty Deposit either monthly or via a one-time payment. Pricing for $1,000 of protection start at just $7/month.

Jetty Deposit remains in place for the entire tenancy meaning there is no need for residents to apply for a new bond when they renew their lease, even if they move units within your community.

To demo our products and join the Jetty network, click here.

Interested in Jetty for your property?

Request DemoLearn more

- Learn More

Build credit by

paying rent. - Learn More

Modern renters

insurance.